A bill of exchange is a specialized type of international draft used to expedite foreign money payments in many types of international transactions. In addition, a draft is commonly used in the U.S. while a bill of exchange is primarily used outside the U.S.

A negotiable instrument is a signed writing, containing an unconditional promise or order to pay a fixed sum of money, to order or bearer, on demand at a definite time. Examples of negotiable instruments include promissory includes which are two party instruments and drafts which are three party instruments.

Thus, a negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand or at a set time.

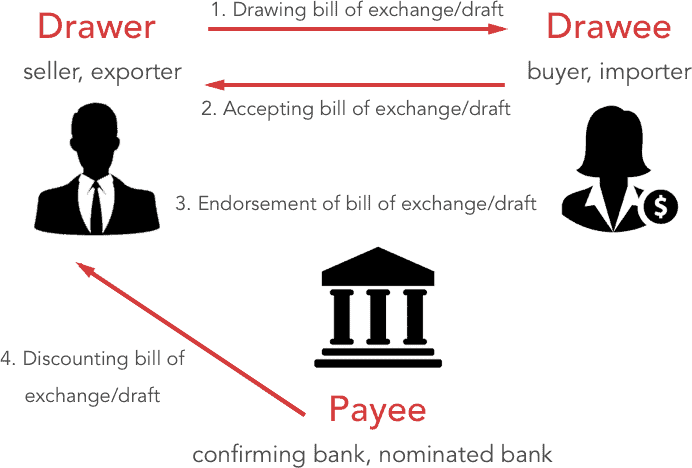

Bill of Exchange Transaction Example

After shipping the goods, the documents for import along with the bill of exchange are submitted to the exporter’s bank. Then, the exporter’s bank then send it to the foreign buyer through the buyer’s bank. The said bill of exchange draws in duplicate as per the specified format. The bill of exchange contains the reference details of shipment, amount of invoice to be receivable from the overseas buyer, the time of payment to be effected, bank details, etc.

A draft is the signed order of the drawer, given to a drawee who in possession of money to which the drawer is entitled, to pay a sum of money to a third party, the payee, on demand or at a definite time. A check is an example of a draft, which is drawn on a bank and payable on demand. The three parties include the drawer, the drawee bank, and the payee.

A documentary draft is used to expire payment in a documentary sale.

These negotiable instruments can serve two purposes:

- They act as a substitute for money

- They act as a financing or credit service

What are the Requirements of a Bill of Exchange?

A bill of exchange should be:

- An unconditional order in writing

- Addressed by one person to another

- Signed by the person giving it

- It requires that the person pay the amount on demand or at a fixed or determinable future time

- A sum certain in money

- To or to the order of a specified person or to bearer