The Profit Maximization Rule states that if a firm chooses to maximize its profits, it must choose that level of output where Marginal Cost (MC) is equal to Marginal Revenue (MR) and the Marginal Cost curve is rising. In other words, it must produce at a level where MC = MR.

Profit Maximization Formula

The profit maximization rule formula is

MC = MR

Marginal Cost is the increase in cost by producing one more unit of the good.

Marginal Revenue is the change in total revenue as a result of changing the rate of sales by one unit. Marginal Revenue is also the slope of Total Revenue.

Profit = Total Revenue – Total Costs

Therefore, profit maximization occurs at the most significant gap or the biggest difference between the total revenue and the total cost.

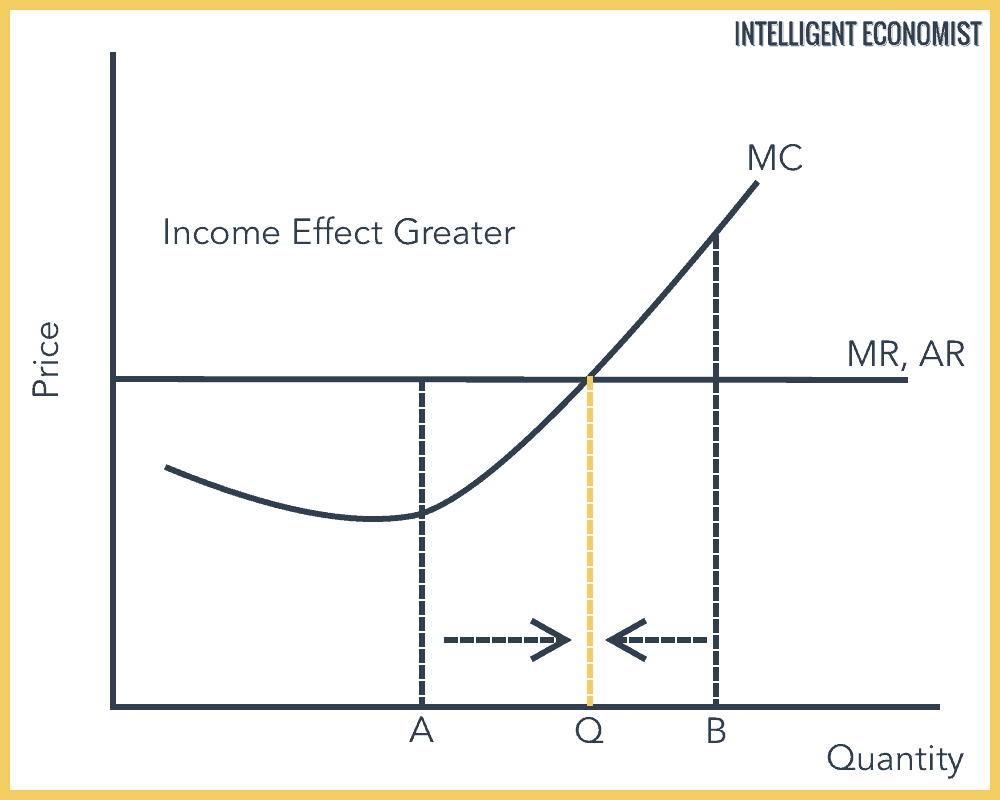

Why is the output chosen at MC = MR?

At A, Marginal Cost < Marginal Revenue, then for each additional unit produced, revenue will be higher than the cost so that you will generate more.

At B, Marginal Cost > Marginal Revenue, then for each extra unit produced, the cost will be higher than revenue so that you will create less.

Thus, optimal quantity produced should be at MC = MR

Application of Marginal Cost = Marginal Revenue

The MC = MR rule is quite versatile so that firms can apply the rule to many other decisions.

For example, you can apply it to hours of operation. You decide to stay open as long as the added revenue from the additional hour exceeds the cost of remaining open another hour.

Or it can be applied to advertising. You should increase the number of times you run your TV commercial as long as the added revenue from running it one more time outweighs the added cost of running it one more time.

Profit Maximization Example

In the early 1960s and before, airlines typically decided to fly additional routes by asking whether the extra revenue from a flight (the Marginal Revenue) was higher than the per-flight cost of the flight.

In other words, they used the rule Marginal Revenue = Total Cost/quantity

Then Continental Airlines broke from the norm and started running flights even when the added revenues were below average cost. The other airlines thought Continental was crazy – but Continental made huge profits.

Eventually, the other carriers followed suit. The per-flight cost consists of variable costs, including jet fuel and pilot salaries, and those are very relevant to the decision about whether to run another flight.

However, the per-flight cost also includes expenditures like rental of terminal space, general and administrative costs, and so on. These costs do not change with an increase in the number of flights, and therefore are irrelevant to that decision.

Limitations of the Profit Maximization Rule (MC = MR)

1. Real World Data

In the real world, it is not so easy to know exactly your Marginal Revenue and Marginal Cost of the last products sold. For example, it is difficult for firms to know the price elasticity of demand for their goods – which determines the MR.

2. Competition

The use of the profit maximization rule also depends on how other firms react. If you increase your price, and other firms may follow, demand may be inelastic. But, if you are the only firm to increase the price, demand will be elastic.

3. Demand Factors

It is difficult to isolate the effect of changing the price on demand. Demand may change due to many other factors apart from price.

4. Barriers to Entry

Increasing prices to maximize profits in the short run could encourage more firms to enter the market. Therefore firms may decide to make less than maximum profits and pursue a higher market share.

Thank you for clarity on MC V/S MR rules

I have a question..

In order to maximize profits a firm should :

a) Sell all units for which MC>MR

b) Sell all units that generate +ve MR

c) Sell all units for which MR> MC

d) Sell as many units as it can possibly make

What will be the answer?

Is it option d)?

C ? Sell all units in which MR>MC ?

What is the correct answer? Explain please?

Thank you so much for your very clear explination of this concept I found it really helpful for my assignment. 🙂

What are the conditions necessary for profit maximization

Is conditions for price maximization same as limitatioms

In a perfect competitive market, the products/ should be homogeneous. Products conditions really matter in determining the price of the commodity.

Favourable condition will attract best price for the commodity

I have a question

Due to product differentiation, MC price increase at costs increase. What should an MC firm do to maximize profit?

a. Minimize differentiation of products

b. Absorb the cost of differentiation, minimizing profit

c. All of the choices

d. Select a combination of price, quality and product differentiation that will maximize profit

I am an orthodox economist. As far as the principle theory of price and MC or MR goes, the initial cost will be higher. But with the production & sale of additional items will reduce the MC & Total costs while increasing the MR & Total Revenue producing the most profits. Here in the chart that is not shown.

Where a firm is selling in two separate market, what is the condition that must be fulfilled in order to maximize the firm’s profit?