Price Elasticity of Demand (PED) is defined as the responsiveness of quantity demanded to a change in price. The demand for a product can be elastic or inelastic, depending on the rate of change in the demand with respect to the change in the price.

What does Price Elasticity mean?

Price Elasticity of Demand is defined as the rate at which demand goes up or down when prices change. The demand for a product can be elastic or inelastic, depending on how quickly that product’s demand responds to changes in the price of that product.

Demand is said to be elastic when the change in demand is proportionally larger than the change in price. In other words, demand is elastic when the demand changes significantly with smaller price changes. Conversely, demand is inelastic when the change in demand is proportionally smaller than the difference in price.

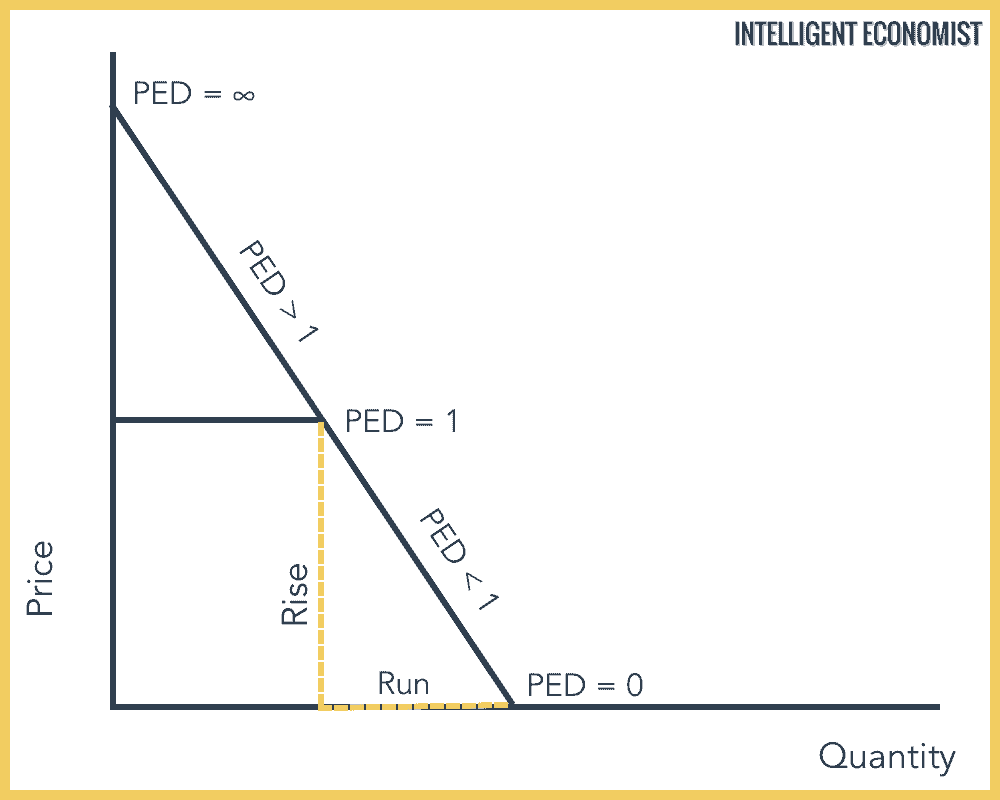

Price Elasticity of Demand is also the slope of the demand curve. We can calculate the slope as “rise over run”. As the slope of the demand curve steepens, demand changes at a faster rate, which represents a higher elasticity. Conversely, flattening the curve causes demand to change at a slower rate, denoting relative inelasticity.

For example, if I increase the price of a phone from $300 to $500, then how much can I expect my demand to fall? The answer to this question, depending on various factors mentioned below, will help the firm calculate its price elasticity of demand.

Key Takeaways:

- Price Elasticity of Demand (PED) is a product’s change in quantity demanded divided by change in price

- It is determined by various factors such as whether there are substitutes for that product, whether or not the product is a necessity and others

- It can be used by policymakers in a variety of practical situations

- One of the most useful applications of PED is to determine the potential Total Revenue of a product depending on price changes

- Perfect elasticity or inelasticity are theoretical concepts which represent infinitely essential and perfectly competitive products, respectively

Determinants of Price Elasticity of Demand

Once a manufacturer or producer knows the price elasticity of demand for their product, it can help them determine the change in Total Revenue if they have to change the price of the product.

“Total Revenue” is the number of goods a manufacturer sells multiplied by the price at which the good is sold. The change in total revenue depends on elasticity. This is important because it helps businesses determine which prices might maximize total revenue, and thus which prices would maximize profits.

1. Substitutes

If there is a greater availability of substitutes for a product, then that product is likely to be more elastic. For example, if the price of one soda brand increases, people can turn to other brands instead. So, a small change in price for this product is likely to cause a greater fall in the quantity demanded for these products.

2. Necessities

If a good is a necessity, then its demand tends to be inelastic. For example, if the price for drinking water rises, then there is not likely to be a huge drop in the quantity demanded of that product, since drinking water is a necessity.

3. Time

Over time, a good tends to become more elastic because consumers and businesses have more time to find alternatives or substitutes. For example, if the price of gasoline increases, people will eventually adjust to that change, i.e. they may drive less, use public transportation, or form carpools.

4. Habit

The demand for addictive or habitual products is usually inelastic. This is because the consumer has no choice but to pay whatever price the producer is demanding. For example, if the price for a pack of cigarettes goes up, it will likely not have any effect on the product’s demand.

Uses of Price Elasticity of Demand

- Price elasticity of demand allows a firm or business to predict the change in total revenue using a projected change in price.

- It provides a useful marker by which firms can find out whether or not any of the determinants listed above are present, e.g. whether or not there are substitutes in the market for a certain product.

- Firms can charge different prices in different markets if elasticities differ in income groups. This practice is known as price discrimination.

- For example, airlines have segmented airplane seats into different classes—economy, business, and first-class, in order to charge the less price-sensitive customer a higher price for premium seats.

- It allows a firm to decide how much tax to pass on to a consumer. If a product is inelastic, then the firm can force the customer to pay the tax.

- This is a common tactic used by cigarette manufacturers who pass on any health tax directly to the consumer.

- It also enables the government to predict the impact of taxation policies, or the effect of other policies that may decrease the demand of a certain product.

Price Elasticity of Demand in Action

Let’s look at three real-world examples of how governments and firms use their knowledge of price elasticity of demand for the purposes listed above.

Case 1: Demand for Higher Education

In a study conducted by Herbert J. Funk, price elasticity of demand is utilized to examine the tuition costs of a private university from 1959 to 1970. The study also keeps track of the number of students enrolled at that university and tuition costs in that timeframe. The purpose of this study was to determine how a change in tuition may affect both how many students enrolled and how much total revenue was earned. It was discovered in the study that the demand curve was slightly inelastic, leading to the conclusion that tuition increases would not have a large effect on either of those variables.

Case 2: Demand for a New Product

Another study measures the elasticity of skim milk, at a time when it was newly introduced to the US market in 1947. While the previous study uses this data to determine changes in total revenue, this study uses it to determine to what extent it was in competition with whole milk. Though the consumption of skim milk increased in the US by about 300 percent, it still only accounted for 3% of milk products, and its newness to the American consumer market made it quite elastic and easily substituted.

Case 3: Demand for Coal

This third case looks at the demand for coal in China from 1998-2012. This study chooses China as the country of focus because it is a country that largely depends on coal as an energy source. Because of this, knowledge of the elasticity of coal prices in China would shed light on whether or not taxes could possibly reduce the demand for coal, and thus reduce the amount of emissions produced by the country as a whole. The study ultimately found that coal was in fact elastic and that changes in price would be effective in reducing emissions.

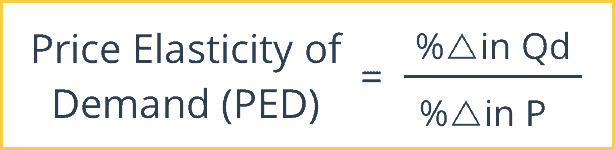

Price Elasticity of Demand Formula

If you’re looking for how to calculate the price elasticity of demand, simply follow this formula.

%∆ in Qd = Percentage Change in Quantity Demanded. The Percentage Change in Quantity Demanded is the New Quantity Demanded minus the Old Quantity Demanded divided by the Old Quantity Demanded.

%∆ in P = Percentage Change in Price. This is the New Price minus the Old Price divided by the Old Price.

PED = %∆ in Qd / %∆ in P

The value of Price Elasticity of Demand (PED) is always negative, i.e. price and demand have an inverse relationship. This is because the ratio of changes of the two variables is in opposite directions, so if the price goes up, demand goes down and the change will end up negative.

We can see by simply looking at the PED whether a product is elastic or inelastic. We will discuss this more in depth later in the article, but as a rule of thumb, a PED which is less than 1 is relatively inelastic, and a PED which is greater than 1 is relatively elastic (using absolute value since the number is negative).

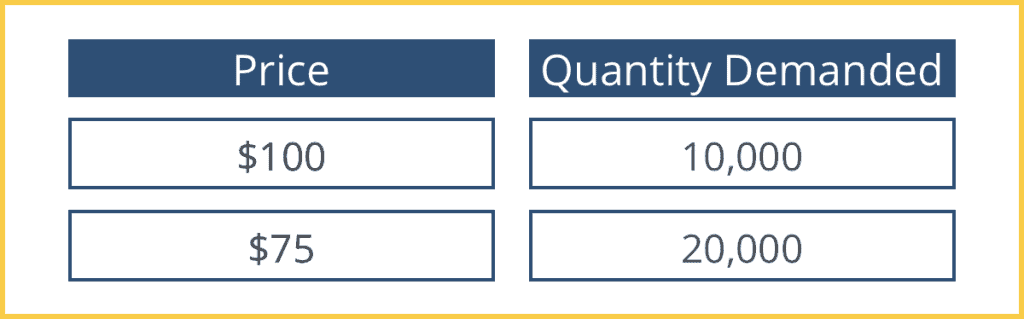

Price Elasticity of Demand Example

For our examples of price elasticity of demand, we will use the price elasticity of demand formula.

Widget Inc. decides to reduce the price of its product, Widget 1.0 from $100 to $75. The company predicts that the sales of Widget 1.0 will increase from 10,000 units a month to 20,000 units a month.

How To Calculate Price Elasticity of Demand

To calculate the price elasticity of demand, first, we will need to calculate the percentage change in quantity demanded and percentage change in price.

% Change in Price = ($75-$100)/($100)= -25%

% Change in Demand = (20,000-10,000)/(10,000) = +100%

Therefore, the Price Elasticity of Demand = 100%/-25% = -4.

This means the demand is relatively elastic.

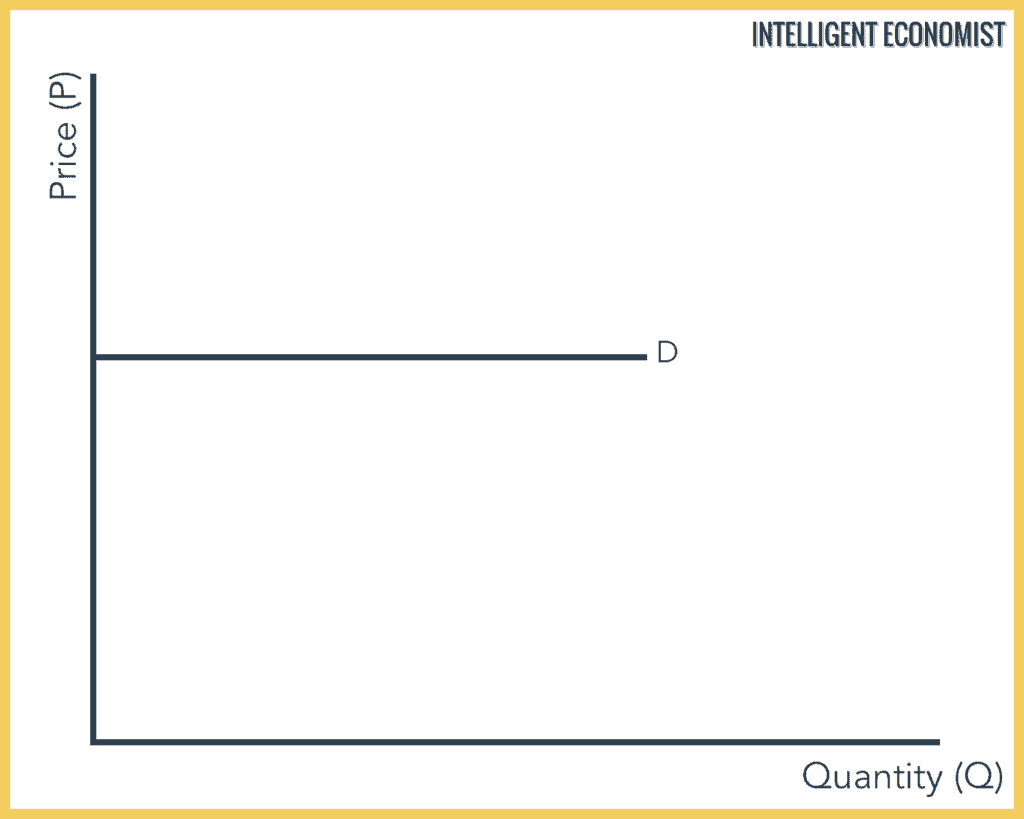

Price Elasticity of Demand on a Demand Curve

We can represent all the different values of price elasticity of demand on a demand curve as seen above.

Types of Price Elasticity of Demand

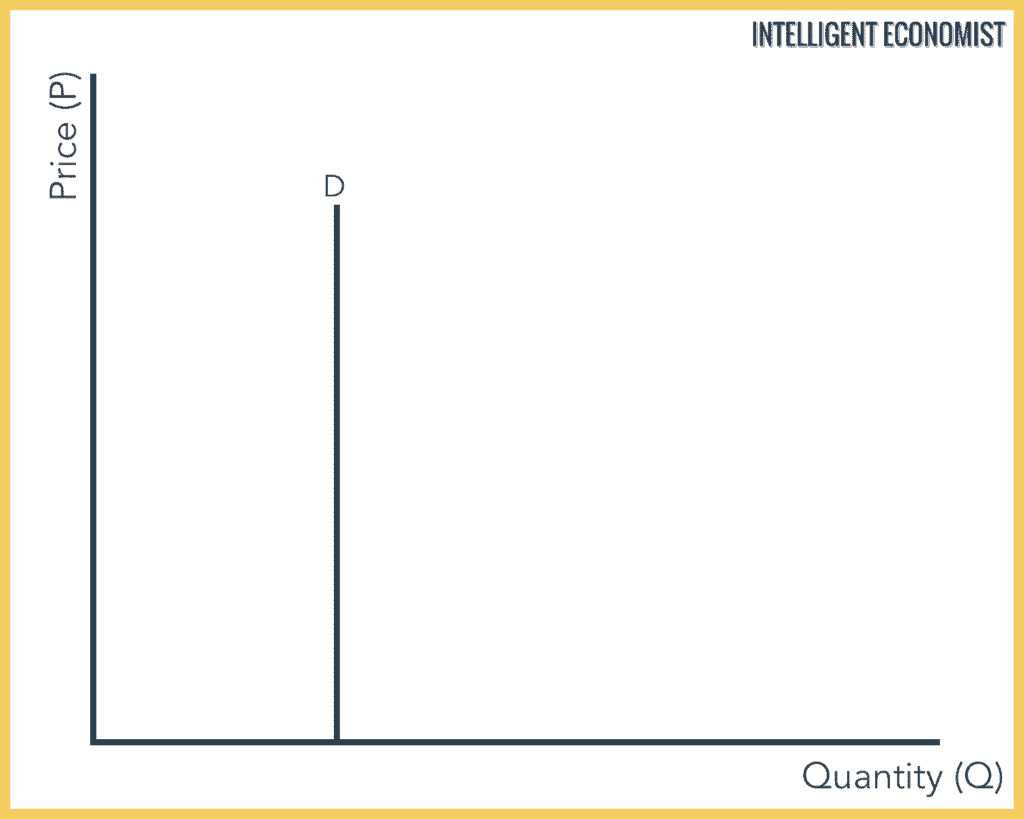

1. Perfectly Inelastic Demand, (PED = 0)

With a perfectly inelastic demand, there is no change in the demand for a product with a change in its price. This means that the demand remains constant for any value of price. The demand curve is represented as a straight vertical line.

It is practically impossible to find a product that has a perfectly inelastic demand. The closest thing could be essentials like water or certain food products.

This is the effect on total revenue with a change in price:

- Price ↑ → Total Revenue ↑

- Price ↓ → Total Revenue ↓

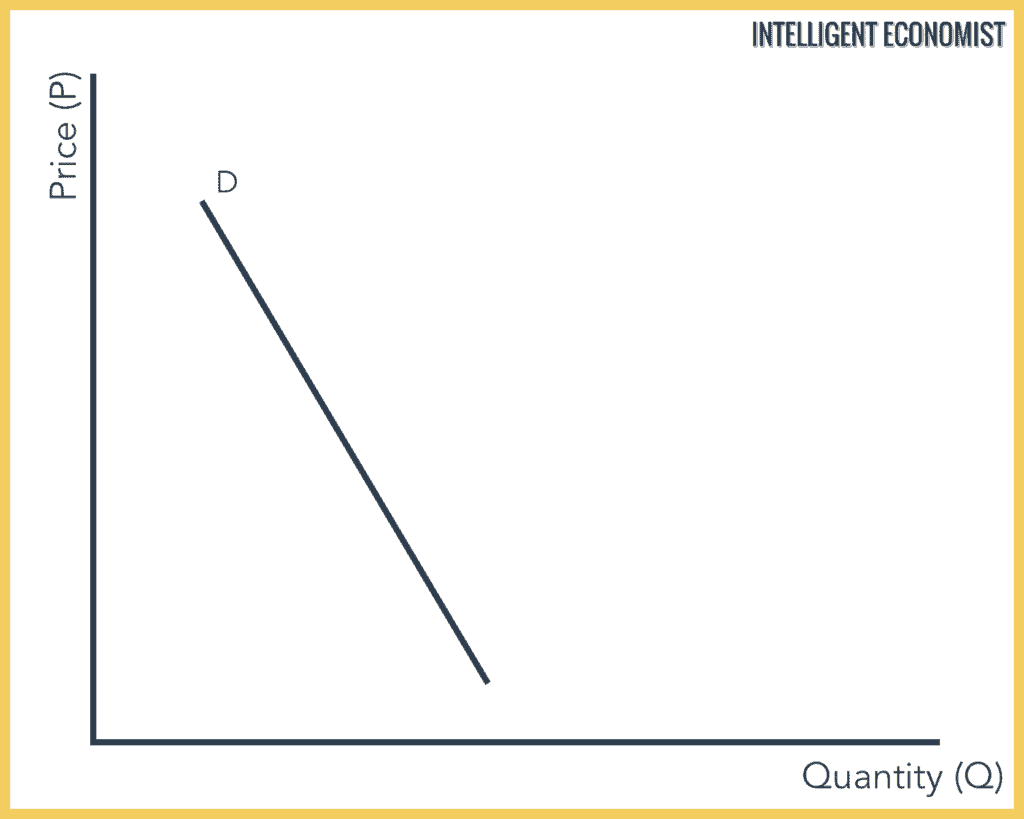

2. Relatively Inelastic Demand, (PED = 0 < x < 1)

Relatively inelastic demand occurs when the percentage change in demand is less than the percentage change in the price of a product.

For example, if the price of a product increases by 15% and the demand for the product decreases only by 7%, then the demand would be called relatively inelastic.

The demand curve of relatively inelastic demand is rapidly sloping.

This is the effect on total revenue with a change in price:

- Price ↑ → Total Revenue ↑

- Price ↓ → Total Revenue ↓

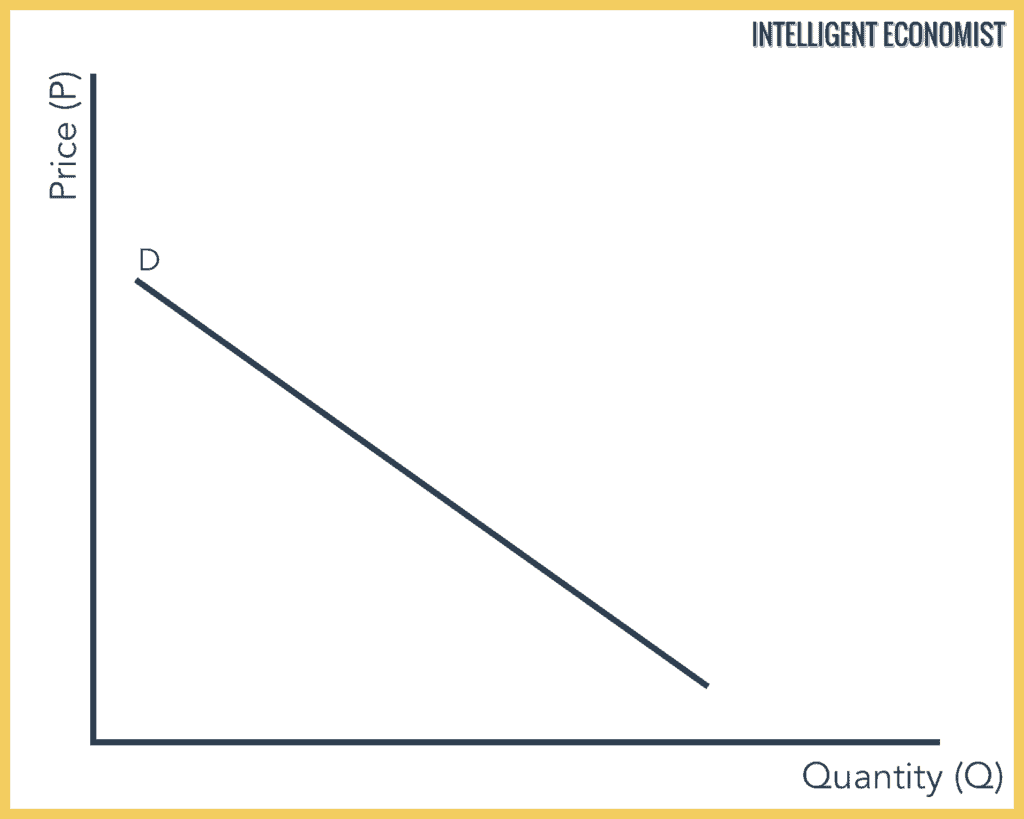

3. Unit Elastic Demand, (PED = 1)

Demand is said to be unit elastic when the proportionate change in demand produces the same change in the price. The quantity demanded changes by the same percentage as the change in price.

This is the effect on total revenue with a change in price:

- Price ↑ → No Change in Total Revenue

- Price ↓ → No Change in Total Revenue

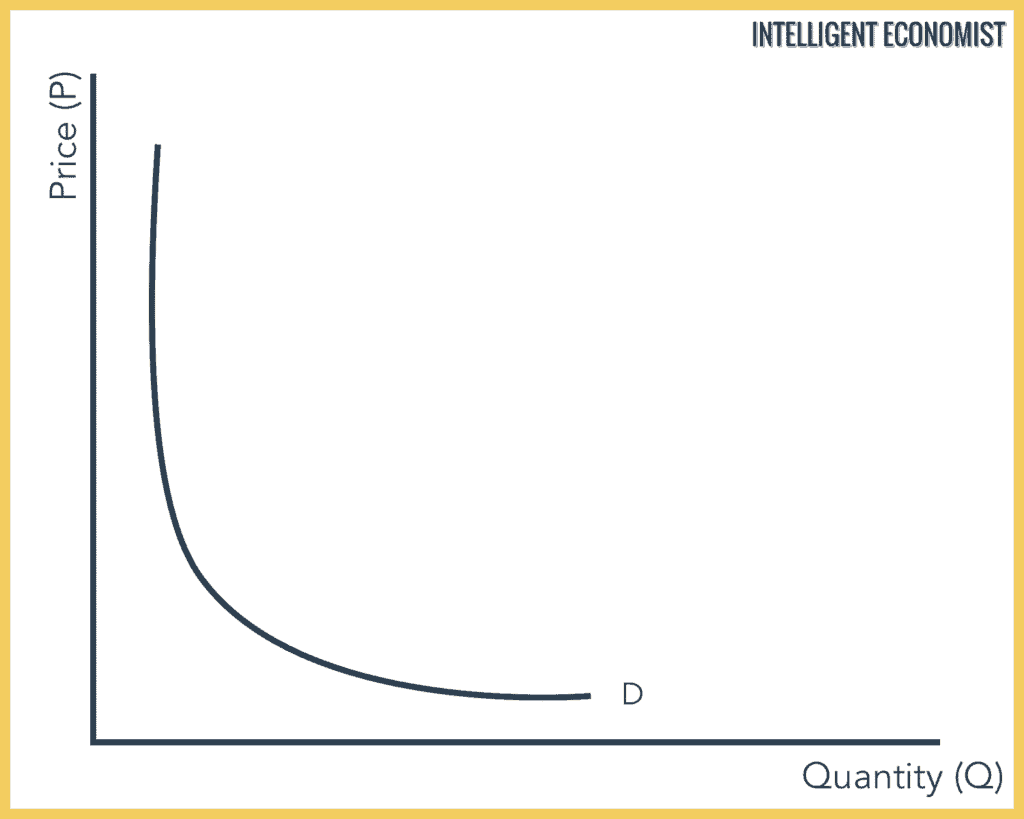

4. Relatively Elastic Demand, (PED = 1 < x < ∞)

Relatively elastic demand is defined as the proportionate change produced in demand is greater than the proportionate change in the price of a product. The quantity demanded changes by a larger percentage than the change in price.

For example, if the price of a product increases by 10% and then the demand for the product decreases by 15%, then the demand would be relatively elastic.

The demand curve of relatively elastic demand is gradually sloping. It is less steep than relatively inelastic demand.

This is the effect on total revenue with a change in price:

- Price ↑ → Total Revenue ↓

- Price ↓ → Total Revenue ↑

5. Perfectly Elastic Demand, (PED = ∞)

In Perfectly Elastic Demand, a small rise in price will result in a fall in demand to zero, while a small fall in price will result in the demand to become infinite. Consumers will buy all available at some price, but none at any other price. This is a theoretical concept because it requires perfect competition where the slightest price increase results in zero demand.

In a perfectly elastic demand, the demand curve is represented as a horizontal straight line.

This is the effect on total revenue with a change in price:

- Price ↑ → 0 Total Revenue

- Price ↓ → 0 Total Revenue

Sources:

- Baker, D. J., & Berry, C. H. (1953). The Price Elasticity of Demand for Fluid Skim Milk. Journal of Farm Economics, 35(1), 124–129. JSTOR. https://doi.org/10.2307/1233648

- Burke, P. J., & Liao, H. (2015). Is the Price Elasticity of Demand for Coal in China Increasing? (SSRN Scholarly Paper ID 2691228). Social Science Research Network. https://papers.ssrn.com/abstract=2691228

- Funk, H. J. (1972). Price Elasticity of Demand for Education at a Private University. The Journal of Educational Research, 66(3), 130–134. JSTOR.

hello sir,

i refer to the last diagram. perfectly elastic demand.

the effect on total revenue.

when price rises, TR = 0

but when price falls, TR will rise significantly.

you have put TR =0 for both .

plz confirm

In perfectly elastic demand, consumers will buy all available at some price, but none at any other price. So any change in price will result in 0 revenue.

What is the meaning of elasticity and rice elasticity ? Im confused? and what is inelasticity

Thank you! I appreciate the feedback

Hello

Can my elasticity of demand be 21? Is that normal or did I do something wrong?

Yes it can be. Elasticity of demand can be infinite

When we read Elasticity of Demand being say -5 why do we understand it as 5?

your explanations are the best , i can finally understand PED.

Thanks sir, I just want to know about the other method for calculating price elasticity – midpoint method. Actually I am confused, when to use percentage method and when to use midpoint method of calculating price elasticity. I will appreciate if you would kindly clear this doubt of mine.

How do you find the change in quantity when you have P1, P2, Q1 and the elasticity at P1?

1) dP% = (P2-P1)/P1

2) dQ% = PED[P1]*dP%

3) Change in quantity = Q2-Q1 = Q1*dQ%