The Harrod Domar model shows the importance of saving and investing in a developing economy. The model was developed independently by Roy F. Harrod and Evsey Domarin 1939. The growth of an economy is positively related to its savings ratio and negatively related to the capital-output ratio. It suggests that there is no natural reason for an economy to have balanced economic growth.

It implies that a higher savings rate allows for more investment in physical capital. This investment can increase the production of goods and services in a country, therefore increasing growth. The capital-output ratio shows how much capital is needed to produce a dollar’s worth of output. It reflects the efficiency of using machines. This efficiency means that a lower capital-output ratio leads to higher economic growth since fewer inputs generate higher outputs.

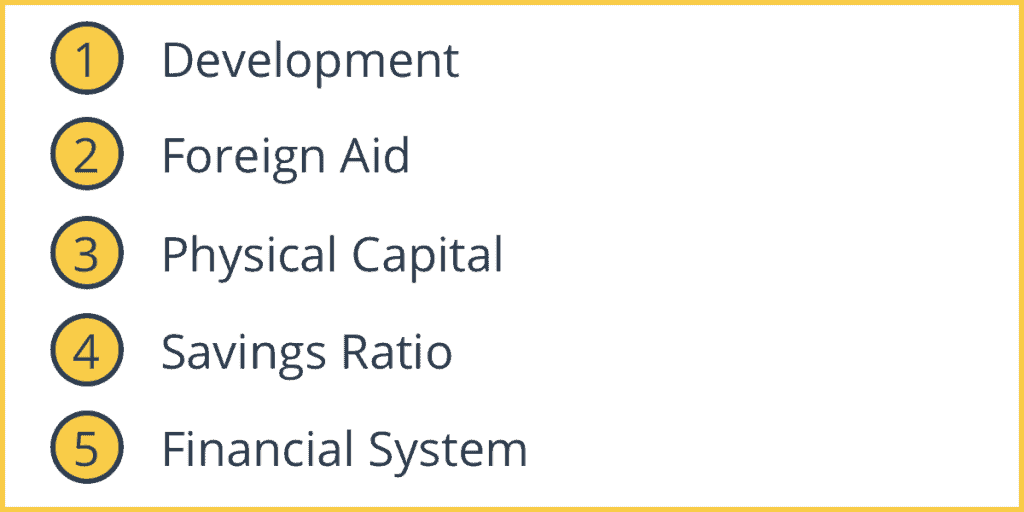

Problems with the Harrod Domar Model

1. Development

The model implies that growth is the same as development. Development is an improvement in factors such as health, education, literacy rates and a decline in poverty levels. Development alleviates people from low standards of living into proper employment with suitable shelter.

2. Foreign Aid

The model focuses on acquiring foreign aid. Foreign aid can be difficult to pay back afterward.

3. Physical Capital

Investment in physical capital in developing countries is not efficient. There are corruption and wastage, so results are not always as expected. Even with more efficient capital, there might not be skilled labor to use the machines efficiently.

4. Savings Ratio

Developing nations tend to have low marginal propensities to save. Families usually spend the additional income earned rather than save it. Increasing the savings ratio will be difficult.

5. Financial System

In an undeveloped financial system, the availability of increased savings may not translate into extra funds for investment. The country may not have the system to maximize savings into loans for businesses.

Why is it regarded as \’Harrod -Domar\’ if you say it is independently developed by just Harrod

That was an error that has been corrected. Thanks