The money multiplier describes how an initial deposit leads to a greater final increase in the total money supply. Also known as “monetary multiplier,” it represents the largest degree to which the money supply is influenced by changes in the quantity of deposits. It identifies the ratio of decrease and/or increase in the money supply in relation to the commensurate decrease and/or increase in deposits.

Let’s explain this another way, in terms of our banking system: in a system of fractional reserve banking, commercial banks must only retain a particular fraction of their deposits in reserves. The reserve ratio is whatever that fraction is.

In this system, the majority of the money supply is generated by such banks, because they only have to hold some of their deposits as reserves; when these banks make loans using the rest of their deposits, this results in the creation of new money. The money multiplier is the greatest amount of money that can be created through this kind of banking.

Money Multiplier Formula

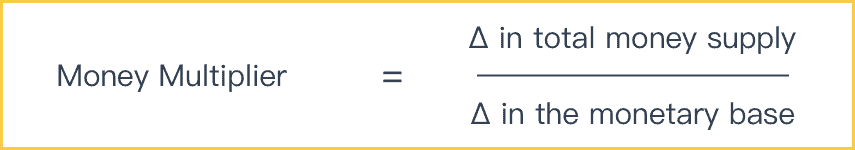

The money multiplier is equal to the change in the total money supply divided by the change in the monetary base (the reserves). Here that is represented as a formula:

Money multiplier = Change in total money supply ÷ Change in the monetary base

How to Calculate Money Multiplier

As you now know, the money multiplier is the amount of money generated by the banking system with a certain amount of their reserves (say, one dollar). The amount of money generated here is determined by the reserve ratio. Let’s call the reserve ratio “R.” The money multiplier is 1 ÷ R, being the inverse of the reserve ratio.

Money Multiplier Formula

Money multiplier = 1 ÷ R

Using this equation, you’ll find that a higher reserve ratio means a lower money multiplier, and likewise, a lower reserve ratio means a higher money multiplier.

Money Multiplier Example

Let’s say your reserve ratio is 10% or 0.1 in decimal form. If we plug that into the equation above, it looks like this:

Money multiplier = 1 ÷ 0.1

Thus, the money multiplier equals 10.

What does this mean in practice? If someone deposits $50, the bank must reserve 10% of that $50, or $5 total. Then, the bank lends out $45. Then other banks experience deposits of $45, of which $4.50 is retained, and $40.50 is lent out. And this cycle continues… see the table below for the continuation of this example:

| Step # | $ deposited | $ reserved | $ lent out by bank | Total deposits so far |

|---|---|---|---|---|

| 1 | $50 | $5 | $45 | $50 |

| 2 | $45 | $4.50 | $40.50 | $95 |

| 3 | $40.50 | $4.05 | $36.45 | $135.50 |

| 4 | $36.45 | $3.64 | $32.81 | $171.95 |

| 5 | $32.81 | $3.28 | $29.53 | $204.76 |

| 6 | $29.53 | $2.95 | $26.58 | $234.29 |

| 7 | $26.58 | $2.66 | $23.92 | $260.87 |

| 8 | $23.92 | $2.39 | $21.53 | $284.79 |

| 9 | $21.53 | $2.15 | $19.38 | $306.32 |

| 10 | $19.38 | $1.94 | $17.44 | $325.70 |

| Totals | $325.70 | $32.56 | $293.14 | Ends at $325.70 |

Money Multiplier in the Real World

The equation above does not account for all of the factors that subtly and not-so-subtly influence the way that the money multiplier effect behaves in the real world. Here are a few of those factors:

- Taxes: A certain fraction of all income is lost to taxes.

- Savings: People don’t spend all their money at all times—they typically save some of it, and often quite a lot of it.

- Bad loans: If a bank lends out money to a company and then that company is forced to file for bankruptcy, that loaned money never returns back to circulation in the banking system.

- Import spending: Money spent on imported products exits the national economy to circulate in other countries.

- Safety reserve ratio: There’s a certain percentage that banks may want to retain above the required reserve ratio; for instance, if the reserve ratio is 10%, banks might in fact choose to reserve extra, perhaps something like 10.3% instead.

- Currency drain ratio: Individuals generally hold some of their money in the form of cash rather than depositing it all in their bank; the percentage of their funds that they keep as cash instead of depositing is the currency drain ratio.

- Impossible to lend more money: Perhaps there aren’t enough people taking out loans to actually reach the limit set by the reserve ratio. For instance, during an economic recession, people tend to save rather than borrowing money—in this case, banks may be unable to lend out their deposits, due to lack of demand.

- Banks choosing not to lend: Also during recessions, especially, banks may be concerned that recipients of loans will have a higher risk of needing to default on their loans, so they may choose not to take the risk and be more conservative about lending out deposits.

Using the Reserve Ratio to Influence Monetary Policy

In the United States, the Federal Reserve can use changes to the reserve ratio to influence the money supply and thereby manage the country’s economy. The aim is to find a balance between limiting inflation and facilitating economic growth.

When the Federal Reserve lowers the reserve ratio, commercial banks can loan out more of their deposits. This leads to more spending activity on a large scale, which increases the money supply, the rate of inflation, and overall economic growth. This is known as expansionary monetary policy.

The opposite approach is contractionary monetary policy, which involves raising the reserve ratio so that banks are able to loan out less of their deposits. In this situation, with fewer loans being made, both growth and inflation decrease. It’s always a matter of locating the right middle ground between the two significant factors of growth and inflation.

Thank you so much you made it easy for me to understand. I am taking classes online and have been struggling in my class and decided to look it up online.