In the field of economics, the term “average variable cost” describes the variable cost for each unit. Variable costs are those that vary with changes in output. Examples of variable costs, otherwise known as direct costs, include some forms of labor costs, raw materials, fuel, etc. This is in contrast to fixed costs, or overheads, which are not affected by output; examples of such costs include rent, insurance, and so forth. The average variable cost is equal to the total variable cost divided by the output.

Use of Average Variable Cost for Firms

Average variable cost is significant in that it is a crucial factor in a given firm’s choice about whether to continue operating. Specifically, the average variable cost should be lower than the marginal revenue in order for the firm to continue operating profitably over time.

In other words, this means that the price of a good should be higher than the average variable cost of the good–in this case, the firm is able to afford all of the variable costs as well as a portion of the fixed costs. And if a firm is selling its goods for lower than the average variable cost, a firm seeking to maximize their profits (as firms typically do) will halt production so as to prevent more variable costs from arising.

How to Calculate Average Variable Cost

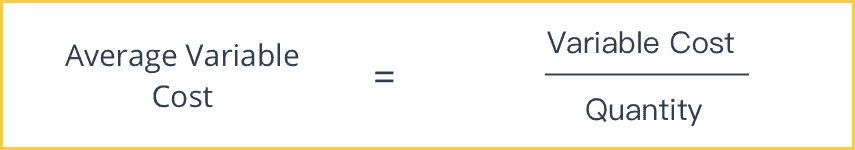

Here is how to find the average variable cost using the average variable cost formula:

AVC = VC / Q

In the above formula, AVC refers to the average variable cost, VC refers to the total variable cost, and Q refers to the output.

Additionally, for any firm, the short-term total costs (TC) can be classified as either fixed costs (FC) or variable costs (VC). This is represented by this formula:

TC = FC + VC

In order to understand this in terms of the cost per unit, divide each side by the output (Q):

TC / Q = (FC / Q) + (VC / Q)

TC divided by Q is equal to the average total cost (that is, ATC). FC divided by Q is the average fixed cost (AFC). Finally, VC divided by Q is the average variable cost (AVC). More info on the relationship between these three types of costs is found in these two equations:

ATC = AVC + AFC

AVC = ATC – AFC

This means that the average variable cost in the short-run is equal to the average fixed cost (AFC) subtracted from the average total cost (ATC).

Average Variable Cost Curve

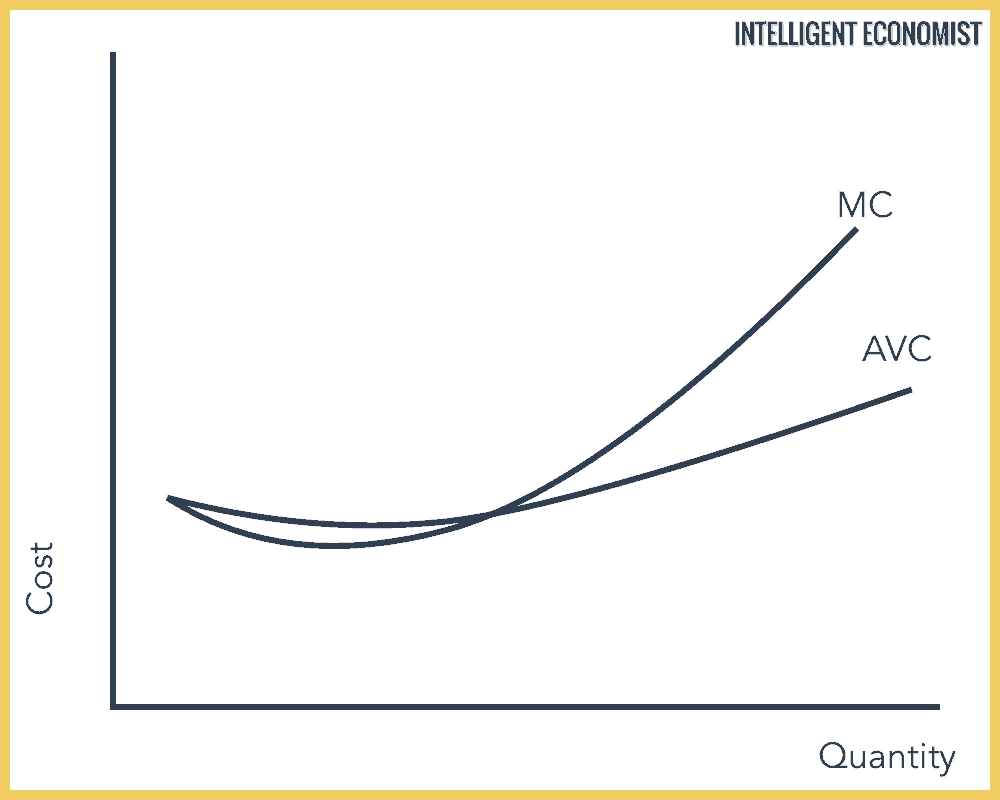

Another way to understand the average variable cost is via the firm’s cost function, which can be plotted as a curve. The curve is a graph showing the relationship between the quantity of production and the average variable cost in the short-term production of a good or service. The curve assumes that other variables beyond the level of output and variable cost (such as the price of resources) remain stable.

By plotting a firm’s average variable cost function, you can arrive at a cost curve that looks like this (for example):

The average variable cost curve is U-shaped (meaning it declines at first but then rises). The marginal product ends up increasing eventually because an input (most often capital) is fixed in the short run, and along with a fixed input, the law of diminishing returns determines the marginal product of factors like labor.

Relationship Between Average Variable Cost and Marginal Cost

The term “marginal cost” refers to the cost of each additional unit of a given product. The cumulative marginal cost of Q units is equal to the total variable cost. This means, then, that the average variable cost is equal to the cumulative marginal cost of Q units, when divided by Q.

If I have only total cost equation TC=80+5Q power 2, then how can I find average variable cost