The interest rate risk structure for interest rates is called the Risk Premium or Risk Spread. It is the extra interest that a risky asset must pay relative to a risk-less asset since investors demand compensation for taking on higher risk.

Contents

show

Interest Rate Risk Structure

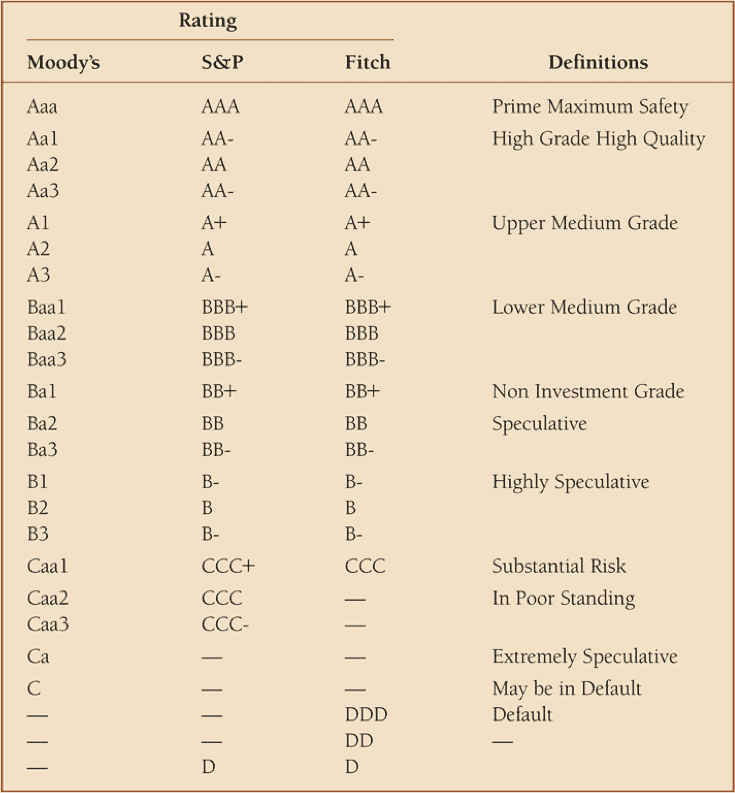

Highly rated investment-grade bonds are those with the lowest risk of default. Junk Bonds have the highest risk premium and are at the highest risk of default. Junk Bonds are anything below Ba, a.k.a non-investment grade.

- Interest on T-Bonds is exempt from State and local taxes but not federal taxes.

- Interest on corporate bonds (& other private assets) taxable at every level – federal, state, local.

- Interest on municipal bonds, not taxed within the home state. These bonds have lower yields than bonds whose interest payments are taxable.

Bond ratings by Moody’s, S&P and Fitch.

Interest Rate Risk Structure Example

Risk Premium = Interest (riskier asset) – Interest (treasury bond)

Ex: T-bonds pay 5% int. after-tax, Corp bond pay 8% after-tax

Risk Premium = 3%