The nominal interest rate is the interest rate that has not yet had inflation accounted for in the overall number. This interest rate will be quoted on things like loans, bonds, and the like. It is the rate “as advertised,” which will not necessarily reflect the reality of how the interest rate will actually manifest as influenced by inflation, compounding interest, taxation, fees, and other such factors.

The nominal interest rate is otherwise known as the annualized percentage rate, which is the interest compounded once per year.

The primary factor that influences the nominal interest rate is inflation/deflation. When deflation occurs, the nominal interest rate decreases; conversely, when inflation occurs, the nominal interest rate increases.

The nominal interest rate is used in a wide variety of contexts, including by banks describing their loans and the interest they will entail, as well as by investment professionals describing potential ways to invest money. It is also used by the Federal Reserve in the form of the federal funds rate, which is considered a nominal rate.

Nominal Interest Rate Formula

The formula representing the nominal interest rate is as follows:

Nominal interest rate = [(1 + real interest rate) x (1 + inflation rate)] – 1

Nominal Interest Rate Formula Example

Let’s try plugging an example into the formula described above.

If the real interest rate is 4%, and the inflation rate is 3%, here’s how that would be represented within that formula:

Nominal interest rate = [(1 + 4%) x (1 + 3%)] – 1

Breaking this down, here’s how that formula would look, step-by-step:

- Nominal interest rate = [(1 + 0.04) x (1 + 0.03)] – 1

- Nominal interest rate = (1.04 x 1.03) – 1

- Nominal interest rate = 1.0712 – 1

- Nominal interest rate = 0.0712 = 7.12%

Rate of Inflation

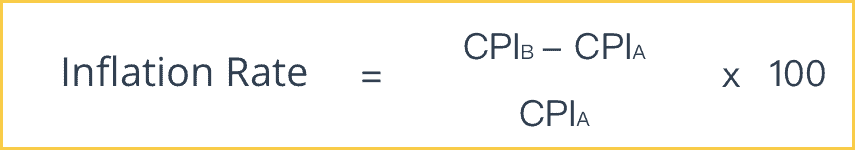

The rate of inflation is how much goods and services increase in price over a year, represented as a percentage. As you’ll need to use the inflation rate to calculate the nominal interest rate, you’re probably wondering how to calculate that number.

This is the formula to calculate the inflation rate:

CPIX refers to the “initial consumer price index,” which is the previous year’s consumer price index.

Difference Between the Nominal Interest Rate and the Real Interest Rate

The difference between the real and nominal interest rates is that the nominal interest rate does not account for the rate of inflation, while the real interest rate does account for inflation. The real interest rate is approximately equal to the nominal interest rate minus the expected rate of inflation.