Purchasing power parity (PPP) is a theory that says that in the long run (typically over several decades), the exchange rates between countries should even out so that goods essentially cost the same amount in both countries.

The Theory of Purchasing Power Parity explains that there should be no arbitrage opportunities (where price differences between countries can result in profit). Purchasing power parity is used to compare the gross domestic product between countries.

PPP is based on the Law of One Price, which implies that all identical goods should have the same price. It is usually calculated using a similar basket of goods in two countries and is also used to evaluate under-/overvalued currencies.

The basket of goods and services priced for the PPP exercise is a sample of all goods and services covered by GDP. The final product list covers around 3,000 consumer goods and services, 30 occupations in government, 200 types of equipment goods and about 15 construction projects. A large number of products are provided so as to enable countries to identify the goods and services that are representative of their domestic expenditures.

Purchasing Power Parity Example

For example: A loaf of bread in the US costs $2, and that amount in Indian Rupees is Indian Rupee ₹90, but a loaf of bread in India costs around Indian Rupee ₹10–that’s about 20 cents. This creates an arbitrage opportunity where people in India can stock up on bread and bring it to the US, where they can sell it to make a nice profit.

The concept of purchasing power parity says that since they are the same goods, the purchasing power in the two countries should be the same. This doesn’t mean the exchange rate should be equal to one; it means the ratio of price to exchange rate should be one. In this example, it implies that exchange rate should be $2 = Indian Rupee ₹10, and $1 = Indian Rupee ₹5. So, the Rupee here is undervalued.

The Real Exchange Rate

The real exchange rate (RER) is a related concept to PPP. It calculates, for example, how many iPods in country A are equal to one iPod in country B. It usually is calculated with a basket of goods.

The Real Exchange Rate Formula

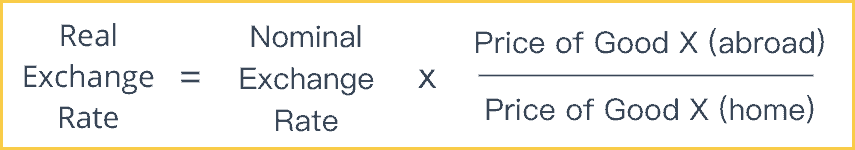

The formula for RER is as follows:

Real Exchange Rate = (Nominal exchange rate) x (Price of the good X abroad / Price of good X at home)

For example, an apple in the US costs $1, and in Mexico, it costs 2 Pesos. The nominal exchange rate is, for example, $0.25 to a Peso. The real exchange rate would be = 0.25 x (2/1) = 0.50.

This rate means that half an apple is the US is the equivalent of one apple in Mexico. This creates an arbitrage opportunity, but if the RER were 1, then we would have a situation of purchasing power parity.

Relative Purchasing Power Parity

The theory of relative purchasing power parity (otherwise known as RPPP) builds upon the idea of standard purchasing power parity so as to account for shifts in inflation as time passes. Relative purchasing power parity includes the idea that countries with higher levels of inflation are likely to end up with their currencies devalued.

RPPP suggests that, between two countries, differing inflation rates, as well as different costs for commodities, will produce shifts in the two countries’ exchange rates. In other words, according to the theory of RPPP, alterations in countries’ inflation rates are directly linked to alterations in their exchange rates.

For example, let’s say there are two countries: Country A and Country B. The average cost of goods in Country A rises 5% in a year due to inflation; meanwhile, the average cost of goods in Country B increases by 7%. Country B has had 2-point higher levels of inflation than Country A over that year. RPPP states that this 2-point difference should lead to a two-point shift in the exchange rate between the two countries. Country A’s currency should appreciate at 2% annually, while Country B’s currency should likewise depreciate at 2% annually.

Relative Purchasing Power Parity Formula

RPPP is calculated as follows:

S = P1 ÷ P2

In this equation, S is equal to the exchange rate of currency #1 and currency #2. Meanwhile, P1 is the cost of a particular good (let’s say good X) in currency #1, while P2 is the cost of good X in currency #2.

Where can I find the exact basket of goods used to calculate the Purchasing Parity Power of a given country?

Thank you