A firm or individual’s decision for allocating its wealth amongst assets is known as the Theory of Asset Demand or Portfolio-Choice Theory.

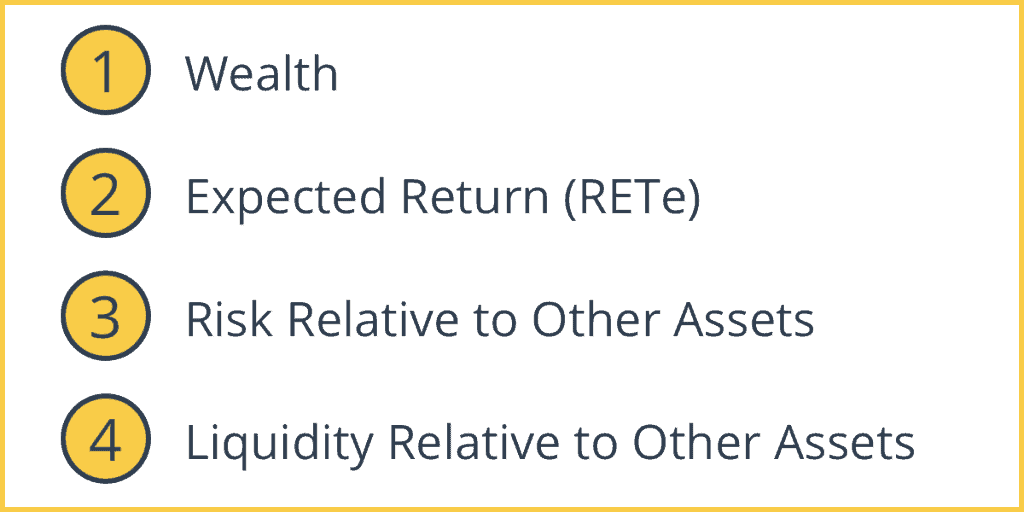

Demand For An Asset Depends On Four Factors

1. Wealth

As wealth increases, the demand for financial assets also increases.

There are two types of financial assets:

- Necessity assets: For example, cash & checking accounts – demand grows slower.

- Luxury assets: For example, stocks & bonds – demand grows faster.

2. Expected Return (RETe)

The Demand for Assets is relative to RETe (real, after tax expected return) on other assets. A Higher RETe results in an increase in demand for assets (and demand for other assets goes down).

3. Risk Relative to Other Assets

When the risk of an asset goes up, demand for one asset goes down, thus increasing demand for other assets.

4. Liquidity Relative to Other Assets

If liquidity goes up, then demand goes up for that asset, thus demand falls for the other assets.

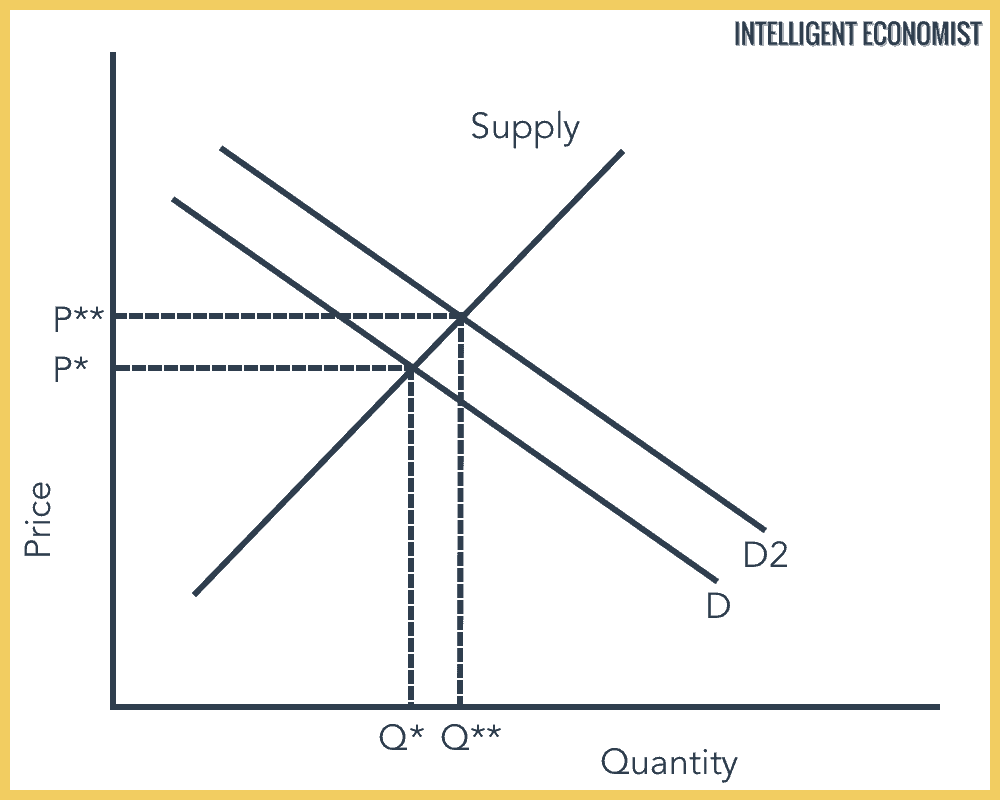

The Demand for an Asset Shifts When

- Wealth increases

- RETe increases

- Riskiness decreases

- Liquidity increases

The Supply for an Asset Shifts When

- There is an increase in expected profitability on capital investment opportunities.

- An increase in expected inflation relative to what other people expect.

- There is an increase in Federal government deficits or state/local government’s willingness to spend on capital projects.

Three Factors That Move Both Supply & Demand

- Economic Fluctuations (investment opportunities increase in a boom, wealth increases )

- Changes in expected inflation

- Tax cuts

Theory of Portfolio Choice

In this graph, the government declares tax exemptions on bond returns. This results in an increase in quantity, an increase in the price of the bond and a decrease in the interest rate of the bonds.