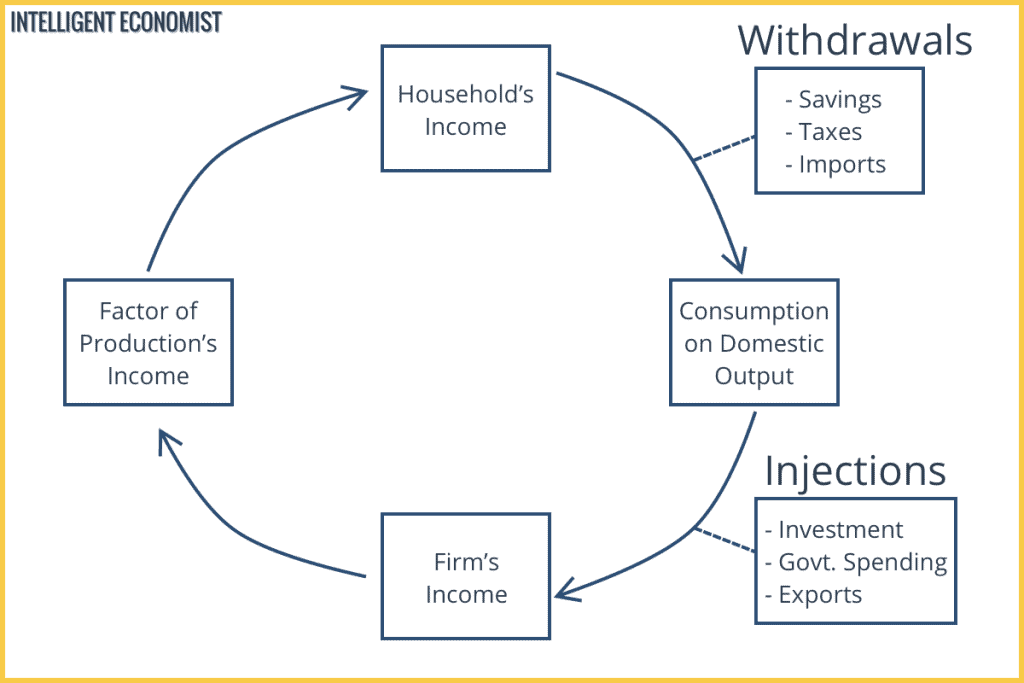

The circular flow of income is illustrated in the circular flow model of the economy, which is one of the most significant basic models within economics. This model shows how different units in an economy interact, breaking things down in a highly simplified manner. It shows how household consumption is a firm’s income, which pays for labor and other factors of production, and how those firms provide households with income. The circular flow of income demonstrates how economists calculate national income, or gross domestic product (GDP).

The Dual Categories for Economic Actors, Markets, and Cycles

Within this model, all economic actors are placed into one of two categories: households or companies (firms).

Likewise, markets are placed in two categories: markets for factors of production (also known as factor markets; factors of production include labor and capital) and markets for goods/services (where households purchase these from firms, using money).

The two cycles represented by these categories, respectively, are as follows: (1) goods and services flowing from individuals/households, to firms, and returning back to individuals/households as we labor to produce goods and services and (2) money flowing from firms, to individuals/households, and returning back to firms as we purchase goods/services with income earned from said labor.

The two cycles described above are crucial parts of the basic functioning of a capitalist economy. Central to the concept of the circular flow of income, and what it attempts to represent in the most basic possible terms, is this key idea: that income flows in a cycle as we both purchase goods/services and earn income via labor producing such goods/services.

What Are the Household and Firm Sectors?

Household Sector

The household sector is made up of people who have unlimited wants. The household sector is responsible for consumption and expenditure.

Firm Sector

The firm sector includes businesses that take on the risk of combining scarce resources to produce goods and services. This sector buys capital goods with investment and pays for the factors of production.

Definitions of Injections & Withdrawals

Injections

Injections are additions and contributions to the economy through government spending, money from exports, and investments made by firms. Injections increase the flow of income.

- Investment (I): Money invested by firms in purchasing capital stock

- Exports (X): Money coming from abroad to buy domestically produced goods

- Government spending (G): Government welfare benefits; spending on infrastructure

Withdrawals

Withdrawals are leakages from the economy as a result of taxation, spending on imports, and monetary savings. Withdrawals reduce the flow of income.

- Savings (S): Money not used to finance consumption, e.g. saved in a bank

- Imports (M): Money sent abroad to purchase foreign goods

- Taxes (T): Money collected by the government, e.g. income tax and value-added tax (VAT)

Factors Excluded from the Basic Circular Flow Model

The basic model is quite simplified in that it incorporates just two sectors: the household and firm sectors. This makes the circular flow model easier to understand but excludes significant elements of the economy that are quite important to understand how it functions in full. These are the three most significant factors excluded from that basic model:

1. Banks & Other Financial Institutions

Leakage (see definition above) occurs via banks, when savings by households and businesses are deposited–the money that would have been flowing through the economy and being used is, instead, removed and held. In terms of injections (also defined in the previous section), investment and loans are also facilitated/offered by these institutions, contributing to the household and firm sector.

2. Government Sector

Government spending is a highly significant portion of the GDP. The government sector also passes laws and collects taxes. The government is responsible for both injection and leakage. Injection occurs via spending on products and resources–government spending–the government provides public goods such as roads, education, and so forth.

The government can also spend on services like welfare programs and business subsidies. Leakage occurs via taxation, including income and sales taxes, among others. But typically the government then uses this money to engage in the injection into the economy described above.

3. Foreign Sector

This sector encompasses imports and exports with other nations–international, rather than intranational, trade. Leakage from and injection into the economy takes place as a result of imports and exports of goods.

Circular Flow Model in the Four Sector Economy

The concept of the four-sector economy incorporates the factor of international trade. International trade includes exports and imports. The four sectors are as follows: household, firm, government, and foreign. The arrows denote the flow of income through the units in the economy. This circular flow of income model also shows injections and leakages.

How do we calculate income method I’m so confused about it?

So helpful to me.Thanks for sharing 🙏