The Multiplier Effect is defined as the change in income to the permanent change in the flow of expenditure that caused it. In other words, the multiplier effect refers to the increase in final income arising from any new injections.

Injections are additions to the economy through government spending, money from exports, and investments made by firms. Injections increase the flow of income. Here are some examples of injections:

- Investment (I). Money invested by firms in purchasing capital stock.

- Exports (X). Money coming from abroad to buy domestically produced goods.

- Government spending (G). Government welfare benefits, spending on infrastructure.

An injection of extra income leads to more spending, which creates more income, and so on. It emphasizes the effect of an expansionary fiscal policy. The Multiplier Effect continues until savings = amount injected. (See the Circular Flow Model)

According to a study published on VoxEU, “Many researchers and policymakers alike have argued that multipliers could be higher during times when unemployment rates are high or when interest rates are at the zero lower bound. Indeed, recent theoretical research has suggested that government spending multipliers can be much larger when the interest rates are at the zero lower bound.”

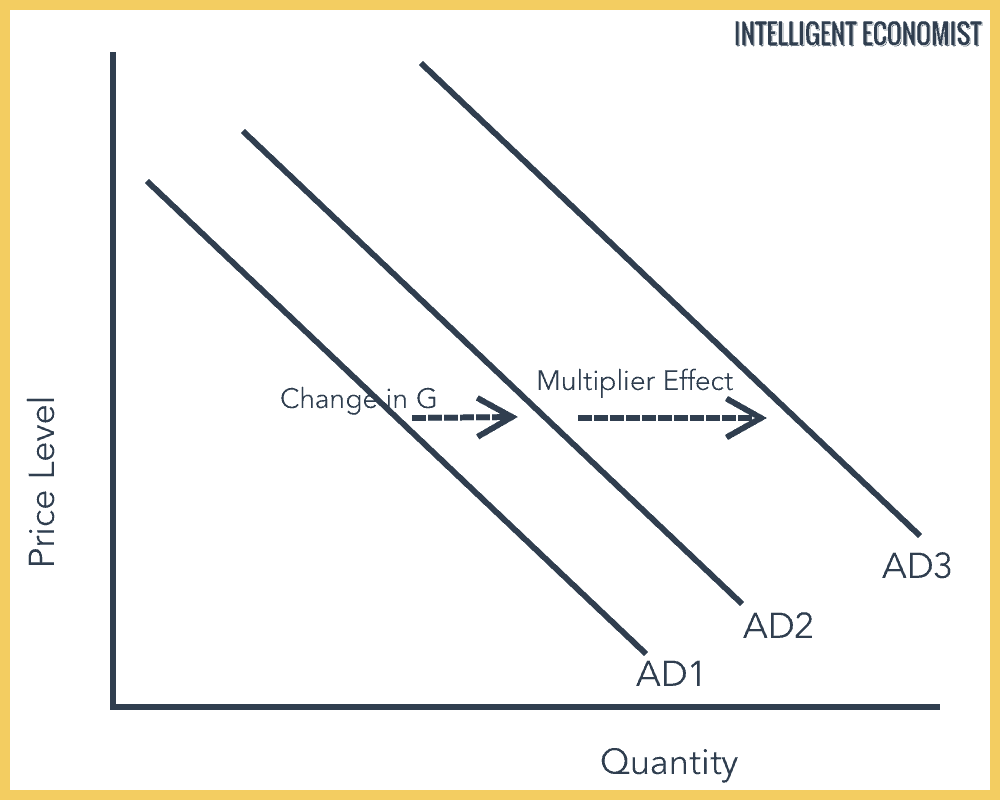

The Multiplier Effect Graph

From the diagram above we can see, that an increase in government spending would shift the Aggregate Demand (AD) curve from AD1 to AD2. However, the multiplier effect shifts the AD curve to AD3 instead of AD2.

The reason for this is because one person’s spending is another’s income, so there’s this constant exchange of money that gets spent.

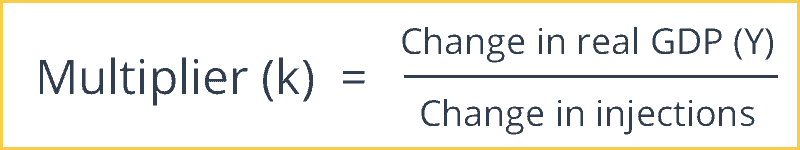

The Multiplier Effect Formula (‘k’)

Important Terms:

1. MRL – Marginal Rate of Leakages

2. MPS – Marginal Propensity to Save

3. MRT – Marginal Rate of Taxation

4. MPM – Marginal Propensity to Import

5. MPC – Marginal Propensity to Consume – The marginal propensity to consume (MPC) is the increase in consumer spending due to an increase in income. This can be expressed as ∆C/∆Y, which is a change in consumption over the change in income.

Calculating the Multiplier Effect for a simple economy

k = 1/MPS

= 1/(1-MPC)

Calculating the Multiplier Effect for a complex economy

k = 1/MRL

= 1/(MPS + MRT + MPM)

= 1/(1-MPC)

Multiplier Effect Example

If the government increases expenditure by $100,000, then the national income or real GDP increases by $100,000. We assume that this money is going towards constructing a new freeway.

However, the $100,000 is only the income for the people who the government pays. In our example, we assume the government hires a firm to construct the road. The company, in turn, pays workers wages. These workers then spend the money.

If the Marginal Propensity to Consume (MPC) is 0.8, which means that the consumer spends 80% of the income. Therefore 0.2 (20%) is saved Marginal Propensity to Save (MPS), it follows that the Multiplier (k) = 5 (since k = 1/(1-0.8)

Therefore, the cumulative effect of the $100,000 added to the economy is $500,000.

Similarly, for a sophisticated economy, we can plug in values for the Marginal Rate of Taxation (MRT), Marginal Propensity to Import (MPM) and Marginal Propensity to Save (MPS) to calculate “k.”

Assuming that the GDP contracts by a given amount, how can the government use the Keynesian multiplier to determine the necessary government spending to correct for that contraction?

Hello Prateek,

I’m working on an analysis to measure the effect of tourism visitor spending in my state (Arizona) as part of the leisure/hospitality industry. All academic examples I see of the multiplier effect use government spending as the baseline. In this case it’s not. There’s visitor spending, operating expenses (which is also local spending), tax revenues (lodging + visitor spending sales taxes). Of course, not all spending stays in the state (I estimate 75% stays).

How would you calculate a defensible multiplier to show GDP contribution or economic impact in this case?

-Mark Beauvais

Phoenix, AZ

It is my understanding that the multiplier effect of consumer spending (whether it’s the purchase of a pack of gum or a new car) is about twice the multiplier effect of government spending; and capital investment spending (starting a new business; expanding a business; upgrading plant and equipment) has a multiplier effect that is at least three times the multiplier effect of government spending. Therefore, every dollar that the government takes out of the hands of consumers or entrepreneurs results in lost opportunity of at least $3. Conversely, if the government spends less, but it enables consumers and entrepreneurs to spend more, the economy will expand much more rapidly.

A fiscal multiplier (k) of >1 cannot exist..

A simple observation demonstrates its failure ─ the assertion that, if the velocity of money is unity, one dollar can produce more than one dollar of goods in one production cycle, defies basic logic. A fallacy in the presentation is apparent.

When A spends on a good produced by B, then B has funds for repeating the production. If B spends on other goods and does not use the funds to repeat the production, then B’s production ceases and B’s spending initiates an equivalent production by another producer. At no time does added production exceed the original spending.

Imagine a hypothetical system where the cost of goods produced (N in millions) is in balance with the price of goods sold (P in millions), and the money (M) available to purchase the goods. The purchases of all goods continually generate new cycles of production of the same amount of goods. Add the new dollars to the economic system. If all goods available remain at N, then absorbing the added spending dictates an increase in prices. If entrepreneurs use the added dollars to produce additional dollars of goods, the economy is in balance again ─ (N+1) cost of goods is in balance with (P+1) price of goods and the available money (M+1) to purchase the goods. After (N+1) goods are sold (MPC=1) in one round of spending, a new production cycle of (N+1) goods starts. Until more money enters the money supply, each production cycle cannot produce more than (N+1) goods.

Taken at face value, the Keynesian Multiplier hits a theoretical inconsistency; when MPC = 1, the multiplication becomes infinite, and the era of abundance has been reached. Actually a MPC = 1 signifies that, if the total of the original investment is spent, reinvested, and continues to be totally spent and reinvested, then, after an infinite number of rounds of spending, the total contribution to GDP (not the value of GDP) during the infinite period will reach infinity.

Rather than being a “multiplier,” the formula is actually a “divider.” Keynes’ formula states that, if not all available spending is used to purchase goods in a production cycle, less goods will be manufactured in succeeding cycles. Eventually, the public will no longer need these specific goods, and manufacturing of those goods will cease. Let MPC=0.8 in the investment series, and, with each investment cycle, the investment is reduced by 20% until it becomes nil and the company stops producing from the original investment. Instead of investment being multiplied by 0.8, investment is reduced by 0.2. If MPC=1, then investment is entirely repeated in each investment cycle and after an infinite number of cycles, total investment reaches infinity. The formula becomes logical and has no indeterminate value.

Keynes’ “investment multiplier” only describes the way the system works ─ sell the goods in one investment cycle, and, if there are additions to demand from additions to the money supply, start a new investment cycle that is greater than the previous cycle by the increased demand. The renowned economist iterated in mathematical terms what all adequate company managers know ─ if you turn over inventory quickly and replace it with new inventory, the enterprise can earn a lot of bucks.