Monetary Policy involves the country’s central bank controlling the interest rate and money supply. Monetary policy affects Aggregate Demand (AD), and an expansionary monetary policy increases AD, while a contractionary monetary policy decreases AD.

The goals of monetary policy are to promote employment, stabilize prices and control long-term interest rates, thereby supporting conditions for long-term economic growth and maximum employment.

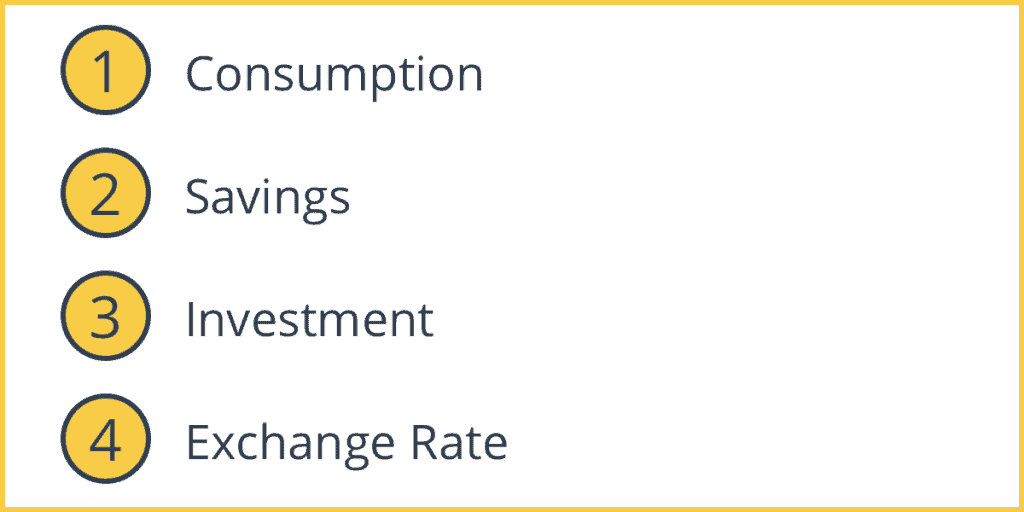

Expansionary Monetary Policy

Expansionary Monetary Policy requires a decrease in the interest rate and/or an increase in the money supply. It is used when the economy is in a recession and unemployment is high.

1. Consumption

Since people make most big purchases (homes, cars, washing machines) on finance, a lower interest rate would encourage spending/consumption.

2. Savings

A lower interest rate could also make savings look less attractive. This will encourage consumer consumption.

3. Investment

Investment will increase as firms will find it more profitable to invest or borrow money. It will become cheaper for businesses to borrow money.

4. Exchange Rate

A lower interest rate could lead to a depreciation in the exchange rate, making exports more attractive than imports.

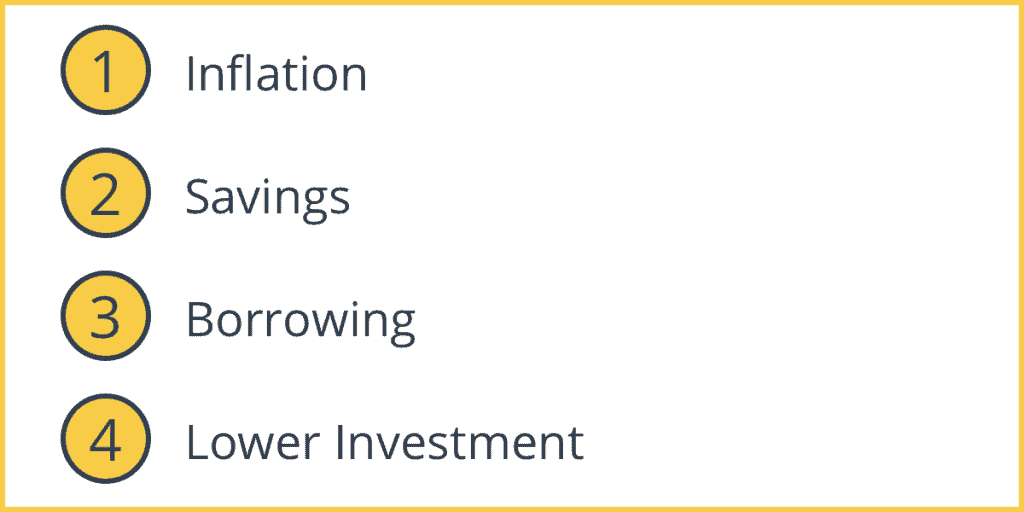

Contractionary Monetary Policy

This policy requires an increase in the interest rate and/or a decrease in the money supply. It is used when economic growth is unstable and inflation is high.

1. Inflation

Uncontrollable inflation could result in an increase in the interest rate, which ;could lower Aggregate Demand.

2. Savings

With a higher interest rate, savings will become more attractive.

3. Borrowing

Consumption will fall as borrowing costs will rise.

4. Lower Investment

Investment will fall as firms will find it more expensive to borrow.

Central Banks, such as the Federal Reserve, have the ability to change interest rates whenever they want. The timing of the change is crucial. The head of the Central Bank plays a very important role in the economy.

Problems with Monetary Policy

- Consumption and investment are not only dependent on the interest rate.

- If the interest rate is near zero, it can’t be reduced any more, making it a useless tool.

- Monetary policy is characterized by time lags, where the effect is only felt several months later.

- Firms and households can borrow from anywhere in the world.

- Under a fixed exchange rate, a change in the interest rate would pressure on the exchange rate.